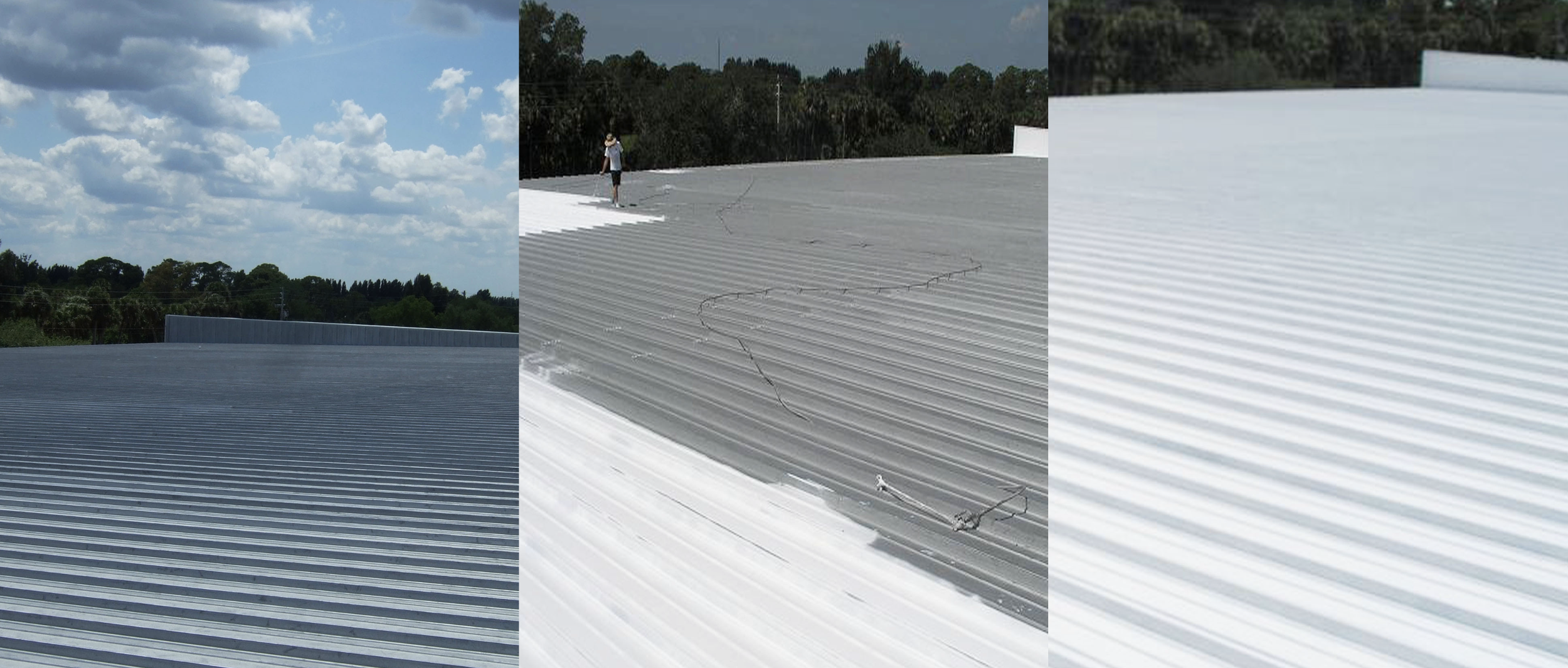

Bring your roof back to life &

lower your energy bills with the

Cool Roofing Network!

4 Benefits of a Liquid Applied Roofing System:

Navigate Roofing Regulations with Ease: Tackle roofing regulations head-on with LARS. The "Two-Roof National Roofing Rule" mandates a full replacement if over 25% of a dual-layered roof requires repair. But with LARS, you can efficiently repair only the damaged sections and then apply a complete liquid roofing solution over the entire surface. This innovative approach circumvents the need for a costly full replacement, saving you time and money.

Cost-Effective Maintenance Over Costly Expenditures: With LARS, your roofing costs are handled as regular maintenance expenses. This contrasts with the hefty capital expenditures of traditional roofing, which depreciates over 28 long years. Our solution offers a financially savvy alternative, keeping your books clear of long-term capital debts.

Tax Incentives for a Greener Roof: Embrace sustainability with LARS and benefit from the Tax Incentive Assistance Program (TIAP), which offers $0.60 per square foot. This federal initiative rewards you for opting for an eco-friendly "Cool Roof." Additionally, utility companies may offer rebates, further incentivizing your smart roofing choice.

Energy Efficiency that Cuts Costs: A LARS Cool Roof significantly reduces your air conditioning requirements by 20-30%, leading to lower electricity bills. Moreover, it enhances the longevity of your AC units. Investing in LARS not only helps in curbing energy consumption but also contributes to a healthier bottom line through reduced operational costs.